Earthquake Insurance Coverage Wake-Up Call: Are You Prepared for the Next Big Disaster

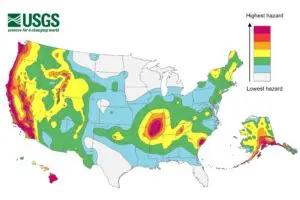

Map of U.S. seismic hazard levels indicating why earthquake insurance matters in high-risk areas.

Even here in the Midwest, home and business owners occasionally ask us if they should worry about earthquake insurance coverage. Some clients and policyholders ask us about earthquake or hurricane insurance in other states to protect their vacation properties or business interests. This Insight addresses our thoughts on how woefully underinsured many home and business owners are in major earthquake zones.

Disclaimer: We are property‑insurance attorneys representing policy owners—not insurance agents—this educational blog offers general information only, not specific legal or insurance‑coverage advice. Please consult with a qualified insurance agent to ensure appropriate property coverage. If your home or business has been damaged by an earthquake and you have earthquake insurance coverage, we are here to help.

Do Americans need Earthquake Insurance?

Major earthquakes might seem like only a West Coast problem, but history and science tell a different story. Powerful quakes have struck the central U.S. before, and experts warn that areas around the country may fall victim to catastrophic property loss. Though most have heard of the San Andreas Fault in California, other fault lines might potentially be even more concerning. The Pacific Northwest’s Cascadia Subduction Zone is a fault line that keeps some of us in the property insurance world up at night, since it could unleash a magnitude 9.0 mega-quake and tsunami which could create catastrophic property loss for Americans without earthquake insurance. If a “Big One” like Cascadia or the San Andreas hits a populated region, the property destruction would be immense – and most standard insurance policies would not cover the damage. In this era of climate-intensified natural disasters, we worry about policyholders financial preparedness for natural disaster related property insurance damage. Home and business property owners need to understand their risks, review their insurance, and know their rights if a natural disaster strikes. Though Earthquake Insurance is expensive, it still may be the prudent move for some insureds in these particularly susceptible regions.

Earthquake Insurance and High-Risk Zones in the U.S.

In recent years, we are hearing more and more from insureds across the country who are at risk or have faced a catastrophic loss after a significant seismic threat or climate related disaster. The West Coast, of course, sits on the notorious San Andreas Fault system, and the Pacific Northwest rests above the Cascadia Subduction Zone – a 700-mile offshore fault capable of generating enormous quakes. In fact, the last Cascadia megaquake in January 1700 was so powerful (estimated ~9.0 magnitude) that it caused coastal land to drop by several feet and sent a tsunami all the way to Japan. Scientists say there is about a 37% chance of a 7.1+ Cascadia quake in the next 50 years.

Another zone of concern is the New Madrid Seismic Zone in the central U.S., centered in Missouri’s bootheel. In 1811–1812, this region was rocked by a series of some of the strongest earthquakes in U.S. history (estimated magnitudes 7.5–7.7). Those quakes were so intense that they were felt over a million square miles – reportedly shaking church bells in Boston, Massachusetts, over a thousand miles away. Today, a similar event in the New Madrid region could devastate parts of Missouri, Arkansas, Tennessee, Kentucky, Illinois and beyond.

Despite these known high-risk zones, many property owners in those areas lack dedicated earthquake coverage. It’s an easy risk to ignore until it’s too late. Talk to a qualified insurance agent to see if earthquake insurance should be part of your plan, it might be a necessary financial safety net if the ground suddenly shakes beneath your home or business.

Standard Policies Exclude Earthquake Damage

It may come as a surprise that a typical homeowners policy will not pay a dime for earthquake damage. As one FEMA resource bluntly notes, standard home insurance “does not cover damage resulting from land movement” (such as earthquakes or landslides). In California, insurers actually stopped automatically including earthquake coverage after the 1994 Northridge quake, because the potential losses from a Big One were deemed capable of bankrupting them. Today, homeowners who want protection against quakes must purchase a separate earthquake insurance endorsement or policy. This special coverage generally carries a high deductible (often 10–20% of the home’s value) and covers structural damage and personal property loss caused by earthquake shaking. Earthquake insurance sold in high‑risk West‑Coast markets usually comes with what the National Association of Insurance Commissioners calls a “percentage deductible,” most commonly, 10-20% of the policy’s dwelling limit, and it applies to both structural repairs and loss of personal property caused by seismic shaking.

In California’s highest‑risk markets, that deductible comes on top of very expensive real estate:

Los Angeles County. Zillow’s July 2025 Home‑Value Index puts the typical single‑family residence at ≈ $970,600; a mid‑range 15 % earthquake deductible equals about $146,000 cash out of pocket before any insurer pays.

San Francisco. Median home value is ≈ $1.29 million, so the same 15 % deductible would start near $193,500.

Statewide context. Even the broader California average of ≈ $786,000 still leaves a 15 % deductible near $118,000—well above most emergency funds.

Commercial exposure is equally steep:

Greater L.A. industrial corridor. Q1‑2025 sales averaged about $299 per ft²; a 50,000‑ft² warehouse therefore represents ≈ $15 million in real‑estate risk, exclusive of inventory and equipment.

San Francisco Central Business District offices. Early‑2025 transactions ran ≈ $282 per ft²; even mid‑sized 100,000‑ft² towers carry $28 million in asset value, all subject to quake damage and the same percentage deductibles.

Those dollar amounts matter because the Uniform California Earthquake Rupture Forecast (UCERF‑3) gives the state a 60 % chance (Los Angeles) and 72 % chance (Bay Area) of at least one M 6.7 quake within 30 years, with USGS scientists calling the statewide likelihood of such an event “greater than 99 %.”

Bottom line: in both residential and commercial sectors along the San Andreas system, high percentage deductibles collide with million‑dollar property values—so policy‑holders must plan now for six‑figure self‑insured costs if “the Big One” strikes.

If you don’t have a specific earthquake policy, you’re essentially “self-insuring” that risk – meaning you’d have to pay out of pocket for any quake damage to your home. Even minor tremors can crack foundations or chimneys that your homeowners insurance won’t cover it. Now imagine a major quake: without the right coverage, a home or business owner could be left with a totaled house, millions in commercial and business losses and no path to an insurance payout. Given how devastating that scenario is, it’s concerning that so few people carry earthquake coverage in the regions that need it most.

Alarming Lack of Earthquake Insurance Coverage

Nationwide, the vast majority of homeowners in earthquake zones do not have earthquake insurance. FEMA reports a striking preparedness gap in the top three earthquake markets: Only about 10% of California residents have earthquake coverage, despite California experiencing about 90% of all U.S. earthquakes. In Washington State – home to part of the Cascadia fault – barely 11% of residents had earthquake insurance as of a few years ago. And perhaps most shocking, in the New Madrid region of Missouri, earthquake policy uptake plummeted from 60% to just 11% between 2000 and 2021 as premiums skyrocketed. In other words, nearly nine out of ten homeowners in these high-risk areas are essentially unprotected from quake damage.

Why the low uptake? Many assume “it won’t happen to me,” or find the extra premium and high deductibles hard to justify. Some may also wrongly believe the federal government will bail everyone out after a disaster (we’ll address that myth shortly). But the hard truth is that if a big earthquake hits and you don’t have coverage, your regular home insurance will not help you. You would have to rely on savings, loans, or limited disaster aid to rebuild your life. Insurance experts and consumer surveys have raised alarms about this coverage gap, calling the nation “underprepared for earthquakes”. The low purchase of earthquake policies means millions of American homes and businesses – even in known fault zones – are one tremor away from a financial catastrophe.

If you’re unsure about your own coverage, now is the time to review your policy. Talk to your agent about adding an earthquake endorsement or a standalone policy, especially if you own property in or near an earthquake-prone area. It’s far better to pay a manageable premium now than to face total loss with no compensation later. And if your insurer doesn’t offer affordable earthquake coverage, an insurance attorney can advise you on your options or any alternative sources of coverage in your state.

A Chain Reaction: Climate Disasters Stressing the Insurance Industry

Earthquakes aren’t the only disasters putting pressure on homeowners and insurers. In recent years, climate change has fueled an onslaught of hurricanes, wildfires, floods, and severe storms across the country – and the insurance industry is feeling the strain. The past few years have repeatedly broken records for billion-dollar disasters. For example, 2024 saw 27 separate U.S. weather and climate disaster events (hurricanes, floods, tornadoes, wildfires, etc.), causing an estimated $183 billion in total damage. This followed a record 28 major disasters in 2023. Insurers have had to pay out staggering sums for these events, from Category 4 hurricanes ravaging the Southeast to massive wildfires wiping out entire communities in California and Hawaii.

When disasters hit back-to-back, insurance companies sometimes struggle to cover all the claims. In fact, in 2023 insurers reported underwriting losses on homeowners’ policies in 18 different states – not just coastal hurricane states, but even places like Iowa and Utah that saw unusual severe weather. Facing heightened losses, some carriers have responded by raising premiums sharply, reducing coverage, or even pulling out of high-risk markets altogether. States like Florida and Louisiana, for instance, have seen major insurers limit new homeowner policies due to repeated hurricane losses. California’s largest insurers have paused new home insurance sales because of catastrophic wildfire payouts and difficulties getting reinsurance. One former state insurance commissioner cautioned that if climate-fueled extreme events continue unabated, we may be “marching steadily toward an uninsurable future”.

For consumers, this insurance industry stress means it’s becoming harder – and more expensive – to protect our homes. Companies that stay in disaster-prone markets are passing costs to policyholders with double-digit rate increases. Coverage exclusions are tightening. In some areas, homeowners are forced into last-resort state insurance pools with limited protection. All of this makes it even more crucial to plan ahead and secure any specialized coverage (like earthquake or flood insurance) that you might need before disaster strikes. It’s also a reminder of how important it is to hold insurers accountable to honor the policies they do sell. If your insurer drags its feet or denies a legitimate claim after a disaster, you have the right to push back – and an experienced attorney can help you fight for the payout you’re entitled to.

Can You Count on a Federal Bailout After a Disaster if you don't have Earthquake Insurance?

Many people assume that if a truly catastrophic earthquake or storm hits, the federal government will step in and make them whole. Unfortunately, that’s not how it works. While federal and state disaster aid can provide some relief, it is usually nowhere near enough to fully rebuild a destroyed home. FEMA assistance is capped and designed to be a safety net, not a replacement for insurance. For example, after the 2017 hurricanes (Harvey, Irma, Maria) and wildfires, Congress did approve unprecedented disaster relief funding – about $130 billion in aid – yet that was only roughly half of the staggering $265 billion in total estimated damages from those events. In practice, individual households see only a fraction of that aid.

FEMA’s main direct aid to individuals comes through the Individuals and Households Program (IHP), which provides grants for temporary housing, basic repairs, and other needs. These grants are modest. After Hurricane Harvey flooded Houston in 2017, the average FEMA housing assistance grant to homeowners was just about $8,900 – enough to make a home habitable, perhaps, but nowhere close to covering severe structural repairs. (By contrast, homeowners with flood insurance received an average of $115,000 per claim from their policies for Harvey floodingresources.org.) FEMA also noted that only about 20% of households affected by Harvey had any insurance coverage at al, which meant federal aid was the last resort for tens of thousands of families. Those without insurance largely had to depend on FEMA grants, SBA disaster loans, or charity – and many still fell short of rebuilding their lives.

We see a similar pattern in other disasters. In the 2023 Maui wildfires that destroyed the town of Lahaina, initial FEMA assistance averaged only a few thousand dollars per household – FEMA approved just $5.6 million total for roughly 2,000 Maui households in the immediate aftermath. Meanwhile, insurance companies (for those who had coverage) have paid out over $2.3 billion in Maui wildfire claims so far, and even that may not cover all the losses. After Hurricane Ian hit Florida in 2022, many homeowners without flood insurance (for storm surge) discovered too late that their homeowners policies wouldn’t pay for the extensive water damage. They had to rely on limited FEMA grants and found that federal aid cannot fully compensate for a destroyed home. The takeaway is clear: Government disaster aid is a helpful stopgap, but it’s no substitute for proper insurance. If multiple catastrophes happen in short succession (imagine a major earthquake and a bad hurricane season in the same year), federal relief funds could be stretched thin, and you definitely cannot bank on a sweeping “bailout” to cover uninsured losses.

Instead, plan as if you’ll be on your own financially after a disaster. That means securing adequate insurance for the perils you face – whether it’s an earthquake, flood, windstorm, or fire. And it means being prepared to advocate for yourself fiercely with your insurer if a claim does arise.

Protecting Your Home and Your Rights

The prospect of earthquakes and other disasters can feel overwhelming, but being informed is the first step toward peace of mind. Start by reviewing your insurance portfolio. Do you need an earthquake policy, flood policy, or other special coverage based on where your property is located? Don’t shy away from asking questions – your insurance agent should help clarify what is and isn’t covered in your homeowner’s policy. Taking steps to harden your home (securing heavy furniture, retrofitting for earthquakes, clearing brush to reduce fire risk, etc.) can also mitigate damage and may even earn you insurance discounts. Most of all, know that as a policyholder you have legal rights. Insurance companies have a duty to handle claims in good faith. Sadly, after large-scale disasters, some insurers delay payments or wrongfully deny valid claims, adding heartbreak to tragedy.

If you ever find yourself in a battle with your insurance company – whether it’s over an earthquake damage claim or any property damage claim – you don’t have to go it alone. An experienced property insurance claims attorney can help hold the insurer accountable to the policy terms and ensure you get the full benefits you paid for. Our firm has decades of experience standing up for policyholders after fires, explosions, storms and other disasters, and we understand the tactics insurers use to limit payouts. We’re here to relieve that burden so you can focus on rebuilding your home and life.

Bottom line: Disasters, from earthquakes to hurricanes, will continue to happen in a warming world. You can’t control Mother Nature, but you can control how prepared you are. Make sure you have the right insurance coverage in place, and don’t hesitate to seek legal guidance if your insurer isn’t meeting its obligations. Recovering from a catastrophe is hard enough – with proper coverage and a strong advocate on your side, you can at least be confident that your financial rights are protected.

If you have questions about your coverage or need help with a denied or delayed claim

Throughout our history, our team of attorneys and experts have helped thousands homeowners and businesses navigate the insurance maze after disaster strikes. Contact us today for a free consultation, and let us put our experience to work for you. Your home is too important to leave to chance – and when the unthinkable happens, we’re here to fight for the recovery you deserve.